What is Cryptocurrency?

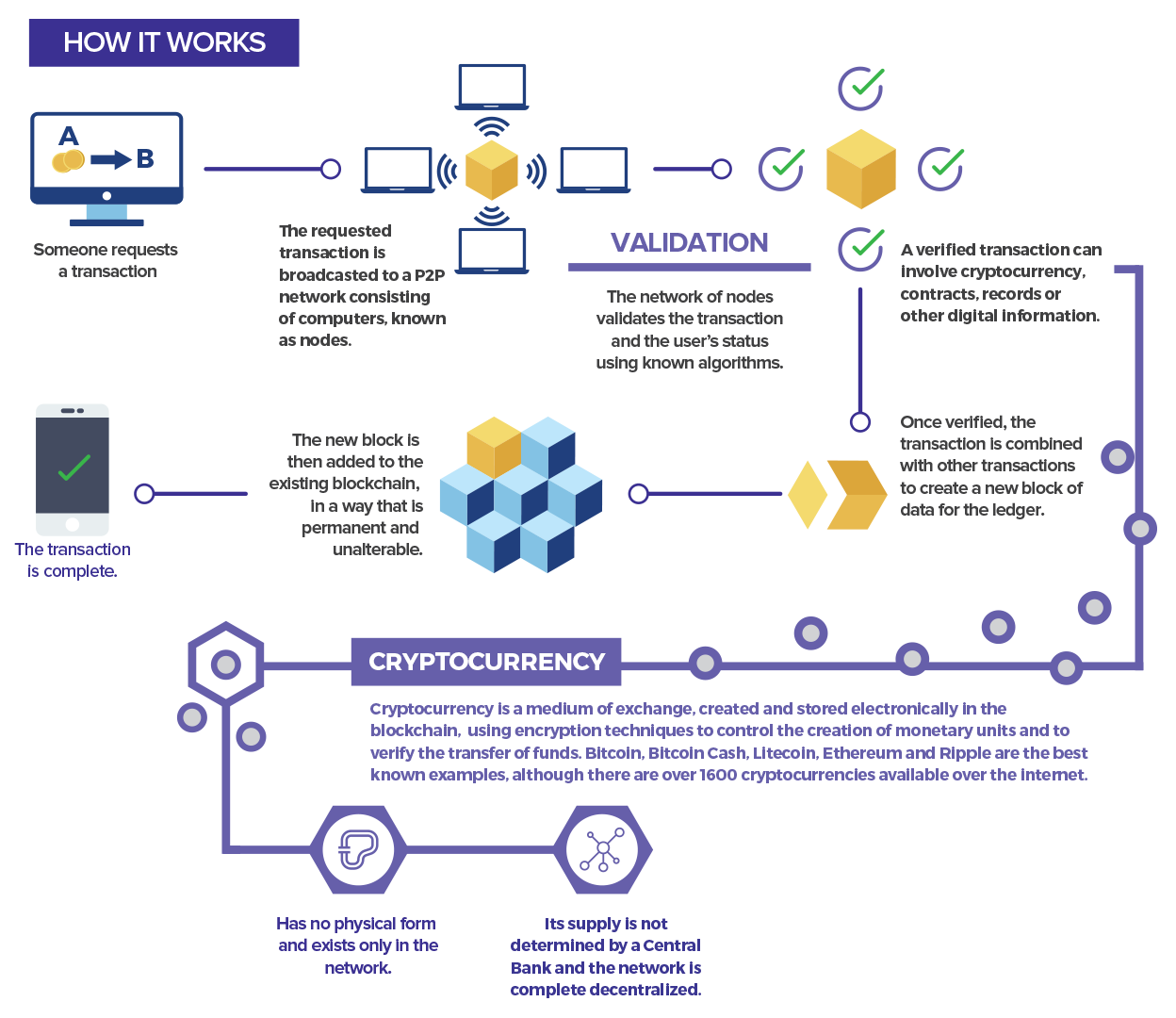

Cryptocurrency operate independently from a Central Bank. The currency uses a variety of digital encryptions to generate units of currency as well as validation of the transfer of funds.

What is the difference between Bitcoin and Cryptocurrency?

Bitcoin is a name for a specific cryptocurrency. Developed in 2008 as a means of peer-to-peer money transfer, Bitcoin has become the most popular form of cryptocurrency. Unlike regulated currency which is centralized with a controlled price, Bitcoin was one of the first digital currencies that operated without any Central Bank regulation.

Because Bitcoin and other cryptocurrencies are decentralized, one of the biggest challenges with adopting a decentralised digital currency was managing the “double-spend” scenario, where someone spent the same cryptocurrency more than once. Bitcoin was able to build a system that allowed users to spend currency digitally and regulate its generation in a decentralized system.

Satoshi Nakamoto, the anonymous developer behind Bitcoin created a system that was able to regulate the spending of digital cash through digital encryption methods that allowed for a decentralized approach and created consensus between those involved.

What is blockchain?

Blockchain is a sequence of databases digitally encrypted to prevent forgery and duplication of currency transactions. These transactions are validated by crypto-miners. Once a miner has validated a “block” of information, this block is added to the sequence, or chain, hence the name Blockchain. The transaction is then validated and cannot be forged or duplicated.

What is the difference between Bitcoin, Ethereum and Lite Cash

Bitcoin is one of over 1600 digital cryptocurrencies on the market. In conventional centralized banking, several currencies make up the modern banking system. The value of each currency is dependent on normal market forces such as supply and demand. With cryptocurrencies, each cryptocurrency is based on blockchain technology but with slight differences, depending on the motivation and environment it was created in.

BITCOIN

Invented in 2009, Bitcoin was designed as a means of electronic payment between two individuals without the need to move through a third party such as a banking institution. This decentralized approach to transactional exchanges has changed the means of moving money and investing. Although the recent trade frenzy of Bitcoin has helped drive up prices, followed by significant dips, most experts would agree that Bitcoin is in fact a store of value. In other words, as demand for a decentralized means of payment increases, the value of Bitcoin will increase. However, there are limited applications for Bitcoin as a means of payment which means that most investors use the currency as a store of value.

Market Cap: $270 Billion

Growth increase: 1500%

As at 30 June 2018

LITECOIN

Litecoin was developed with the specific purpose of being used as a faster means of payment. Its inventor, Chris Lee, claims that a transaction using Litecoin is 100 times faster than Bitcoin, it’s closest currency in terms of application and use.

Litecoin, although still in its early adoption phase, will probably create the most demand for cryptocurrency based on the ability to use it for payments and transactions.

Market Cap: $16 bilion

Growth Increase: 6000%

As at 30 June 2018

ETHEREUM

Although Ethereum is based on Blockchain technology, it has some unique differences to Bitcoin. Ethereum is designed to remove the environment for errors where large transactional contracts are concerned. Smart contracts through Ethereum technology allow for the centralized amendment and updating of a commercial contract whilst reducing errors. Because the terms of the contract are coded in Blockchain technology, once the terms of the contract are discharged, the deal will be concluded and the Ether generated. Several multinational investment firms are experimenting with Ethereum

Market Cap: $70 billion

Growth increase 800%

As at 30 June 2018

RIPPLE

As traditional means of trade are changed by new technologies, means of payment have become more complex. Traders looking for a secure, decentralized means of payment across international boundaries use Ripple. That is at least how the currency markets itself.

Whereas international transactions may take a few days, high volume, low margin transactions are tedious and not as profitable for banking institutions. Ripple has been experimenting with various means of lowering the cost to serve in making cross-border payments.

Market Cap: $21 Billion

Growth Increase: 8000%

As at 30 June 2018

Bitcoin – South African Rand (ZAR)

| Symbol | Name | ZAR | Change 1h | Change 24h | Change 7d |

|---|---|---|---|---|---|

| BTC | Bitcoin | 1,687,107.08 | -0.02% | +1.10% | +2.86% |

| ETC | Ethereum Classic | 467.83 | +0.08% | -2.39% | +16.71% |

| LTC | Litecoin | 1,555.79 | -0.11% | -4.37% | +13.75% |

| DASH | DigitalCash | 506.36 | -0.44% | -6.57% | +9.48% |

| ETH | Ethereum | 56,718.28 | +0.03% | -0.14% | -1.92% |